National Bankruptcy Research Center October 2010 Bankruptcy Filings Report

|

The raw numbers suggest that bankruptcy filings in October rose slightly from the previous month (to 132,000 from 130,000). But that trivial increase suggests a substantial break in the upward trend of bankruptcy filings we have observed since passage of the bankruptcy reform statute in 2005. Thus, as a seasonal matter, October filings typically are the highest filings of the year, about ten percent higher than September filings, so on a seasonally adjusted basis, filings in October were actually seven percent lower than filings in September. More notably, filings in October of this year were three percent lower than filings last October: that represents the first year-on-year decrease in bankruptcy filings since 2006. Year-to-date filings for 2010 are still ten percent higher than last year’s, but for once the rate of filings has fallen.

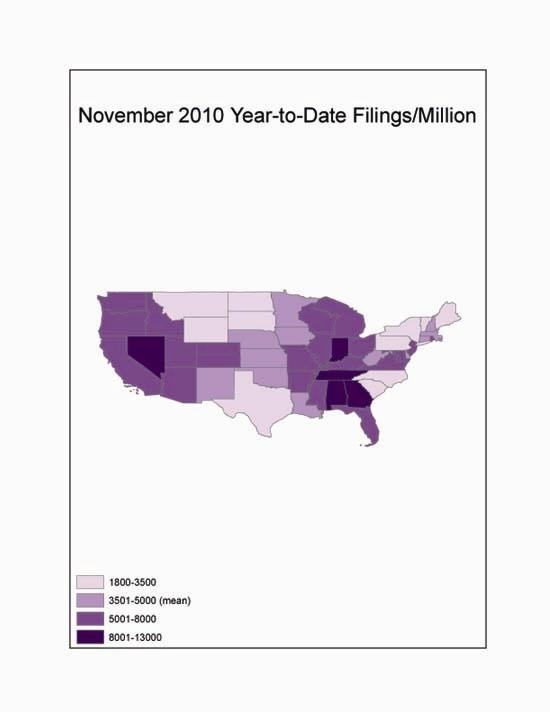

Nationwide, filings this year to date amount to about 5600 filings per million individuals, about 1 in every 175 people. Through the course of 2010 the filing rates have become increasingly disparate throughout the country. As the attached map shows, the highest filing rates are concentrated in the Southwest and a swathe cutting up from the Southeast. Thus, on a population-adjusted basis, Nevada has substantially more than twice the national filing rate (12,700 filings per million this year). In the Southeast, Georgia, California, Utah, and Tennessee follow with about 50% more than the national average (16,000-17,000 filings per million households this year). The lowest filing rates, by contrast -- seven states had rates less than half the national average – are scattered throughout the country, generally in states remote from the aggressive lending activity that characterized the bubble of the last decade: Alaska, the District of Columbia, South Carolina, Texas, North Dakota, South Dakota, and Vermont.

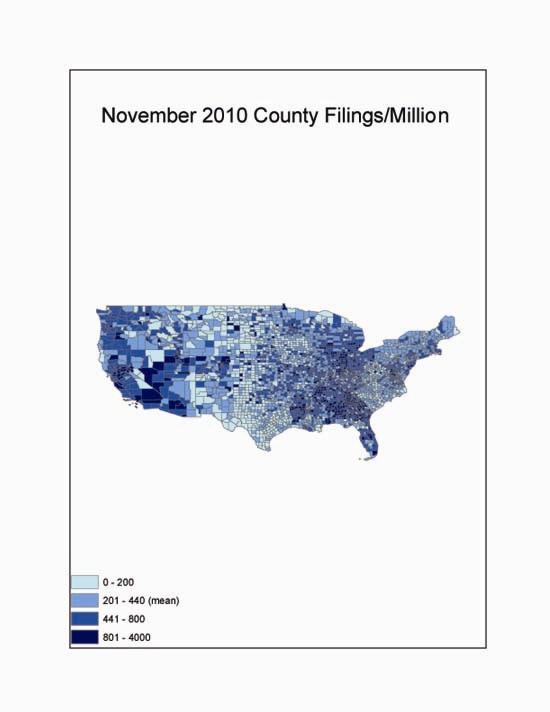

The variation at the county level is particularly provocative. As the attached map shows, the counties with the highest filing rates (adjusting for county population) in October are concentrated in the Southeast. Excluding small counties with less than ten filings, Henry County, Georgia (near Atlanta) had the highest rate – about 1900 filings per million, more than three and a half times the national average. Six of the next nine counties with high filing rates are in suburban and rural Georgia near Atlanta. The most noteworthy urban county (second highest overall) is Shelby County, Tennessee (Memphis), which also had about 1900 filings per million. At the other end of the spectrum, the lowest filing rate in the country last month among urban counties (with a population more than 100,000) was in Rowan County, North Carolina (Salisbury) – with a filing rate (84 filings/million) substantially less than one-fifth the national average.

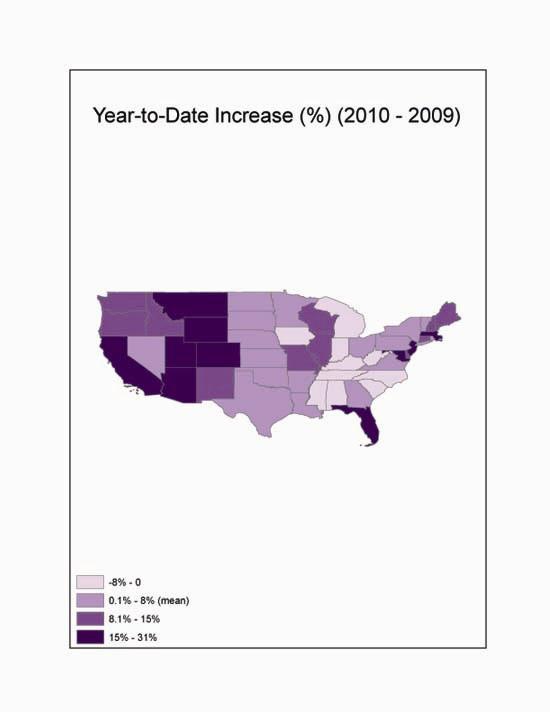

Another accelerating trend in the data is the sharp disparity in changes since last year. Where a few states (mostly in the Deep South) already have begun to see rates fall after the recession, some states continue to experience sharp increases, even by comparison to the elevated filing rates of 2009. Thus, despite the nationally noteworthy high filings in Memphis, filings throughout Tennessee have fallen eight percent since last year; filings have fallen by lesser amounts in West Virginia, South Carolina, Iowa, Mississippi, North Carolina, Kentucky, and Michigan. By contrast, filings have risen by more than 25% this year in much of the far Southwest (Hawaii, California, Arizona, and Utah).

The data also reflect the continued prevalence of Chapter 7 (liquidation) filings; only 30% of the October filings sought relief under Chapter 13 (rehabilitation). The continuing decline in the share of Chapter 13 filings contrasts with the strong push by Congress in its 2005 bankruptcy legislation to encourage bankrupts to choose Chapter 13 rather than Chapter 7. As is typical, there was a substantial variation among the States in the prevalence of bankrupts seeking Chapter 13 relief. The States with the highest share of Chapter 13 filings remain concentrated in the Gulf Coast. Thus, 62% of filings this year in Louisiana have been under Chapter 13, with similarly high shares in Alabama (56%) and Texas (50%). At the other end of the spectrum were States with relatively low Chapter 13 shares; New Mexico, Iowa, South Dakota, West Virginia, and Connecticut all had no more than 10% of their filings under Chapter 13.

This analysis was performed on data collected by the National Bankruptcy Research Center (NBKRC) by NBKRC contributor Professor Ronald Mann of the Columbia Law School.

|