National Bankruptcy Research Center May 2010 Bankruptcy Filings Report

|

Bankruptcy filings in May 2010 fell slightly to 137,000 (from 145,000 in April). Because April and May filings usually are at about the same level, this suggests that bankruptcy filings were essentially constant through May, with perhaps a slight decline. Still, filings for 2010 to date remain substantially higher than those for 2009, about 15% higher than during the first five months of last year.

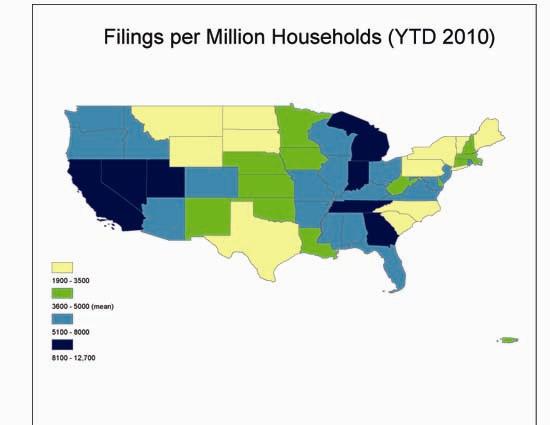

Nationwide, filings to date amounted to about 5700 filings per million households – about 1 in every 175 households. As the attached map shows, the high filing rates are concentrated in two clusters: the Southwest and the Southeast. Two states stand out as having exceptionally high household-adjusted bankruptcy filing rates -- Nevada (substantially more than twice the national average) and Georgia (more than 50% above the national average). The lowest filing rates were in Alaska, followed by the District of Columbia, and South Carolina (all less than 40% of the national average).

The variation at the county level is particularly provocative, because the counties with the highest filing rates (adjusting for households located in the county) are concentrated in a small portion of a single state: the suburbs of Atlanta, Georgia. Six of the ten counties with the highest filing rates were in Georgia, with the highest rate in the country (almost 4000 filings/million households in May alone, more than three times the national average for May) occurring in Henry County, Georgia.

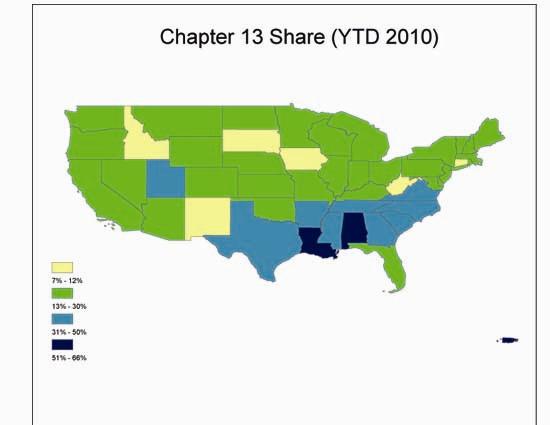

The data also reflect the continued prevalence of Chapter 7 (liquidation) filings; only 26% of the May filings sought relief under Chapter 13 (rehabilitation). The continuing decline in the share of Chapter 13 filings contrasts with the strong push by Congress in its 2005 bankruptcy legislation to encourage bankrupts to choose Chapter 13 rather than Chapter 7. As is typical, there was a substantial variation among the States in the prevalence of bankrupts seeking Chapter 13 relief. The States with the highest share of Chapter 13 filings remain concentrated in the South. Thus, 66% of Louisiana filings and 52% of Alabama filings were under Chapter 13. At the other end of the spectrum were States with relatively low Chapter 13 shares; Iowa, South Dakota, Connecticut and New Mexico all had less than 10% of their filings under Chapter 13.

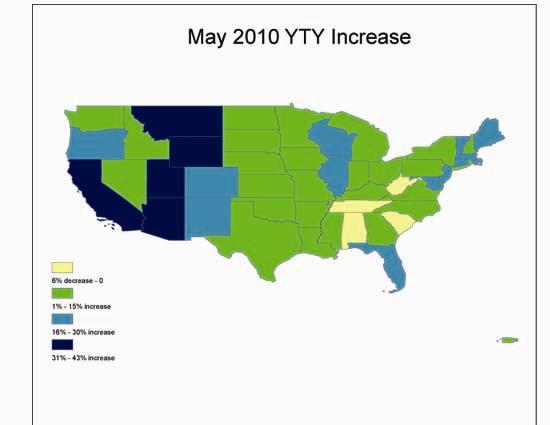

The other noteworthy trend in the data is the sharp disparity in changes since last year. Where a few states already have begun to see rates fall after the recession, some states continue to experience sharp increases, even by comparison to the elevated filing rates of 2009. Thus, filings in southern states like Tennessee, South Carolina, Alabama, and West Virginia have fallen since last year. On the other hand filings in Arizona and California, by contrast, have risen by 43% and 36% respectively. The attached map displays the pattern graphically.

This analysis was performed on data collected by the National Bankruptcy Research Center (NBKRC) by NBKRC contributor Professor Ronald Mann of the Columbia Law School.

|

|