National Bankruptcy Research Center January 2010 Bankruptcy Filings Report

|

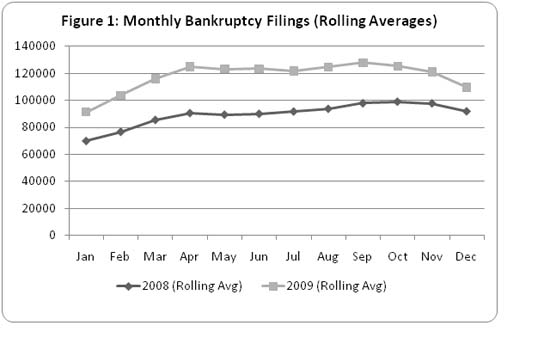

Bankruptcy filings in January 2010 fell to 103,000, from 114,000 in December, consistent with the fact that January usually has the least filings of the year. However, filings were 15% higher than last January. On a seasonally adjusted basis, which accounts for typical variation in monthly filings through the course of the year, January filings in fact were up more than 15% from December. The adjustment for the seasonal variation captures both the effect of the time of the year and the number of calendar days for the month. Still, on a rolling three-month basis (see attached figure), bankruptcy filings continue to fall toward their levels of a year ago. Thus, it appears, the rate of increase in filings attributable to the financial crisis seems to be continuing its decline.

The filings also reflect the continued prevalence of Chapter 7 (liquidation) filings; only 31% of the January filings sought relief under Chapter 13 (rehabilitation), down from a 33% share last January. The continuing decline in the share of Chapter 13 filings contrasts with the strong push by Congress in its 2005 bankruptcy legislation to encourage bankrupts to choose Chapter 13 rather than Chapter 7. As is typical, there was a substantial variation among the States in the prevalence of bankrupts seeking Chapter 13 relief. The States with the highest share of Chapter 13 filings were concentrated in the South. Louisiana’s share was 68%, followed by Alabama, Texas, Tennessee, and South Carolina (all more than 50%). At the other end of the spectrum were States with relatively low Chapter 13 shares; Iowa, South Dakota, and New Mexico all had about 10% of their filings under Chapter 13.

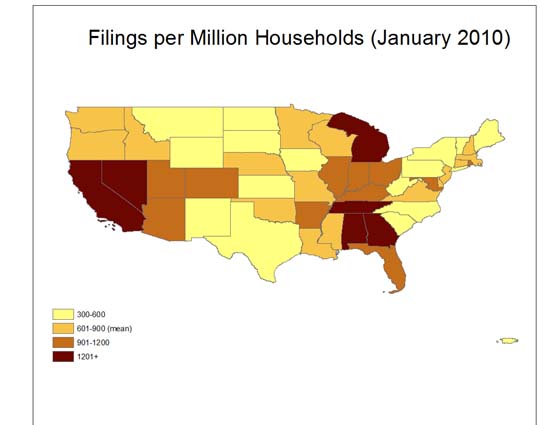

Nationwide, January filings amounted to about 900 filings per million households – about 1 in every 1100 households. As the attached map shows, the high filing rates are concentrated in two clusters: the Southwest and the Southeast. The states with the highest household-adjusted bankruptcy filing rates are Nevada (twice the national average), followed by Georgia and Tennessee (one and a half times the national average), California, and Alabama (with household-adjusted filing rates more than one and a half times the national average). The lowest filing rates were in Alaska (less than a third of the national average), followed by South Dakota, North Dakota, the District of Columbia, and Wyoming (all far less than half the national average).

At the county level, the counties with the highest filing rates (adjusting for households located in the county) were concentrated in Georgia. Seven of the ten counties with the highest filing rates were in Georgia, with the highest rate in the country (almost three and a half times the national average) occurring in Shelby County, Tennessee (Memphis). The second and third highest filing rates were in two suburban Atlanta counties (Douglas and Henry), both with filing rates more than three times the national average.

This analysis was performed on data collected by the National Bankruptcy Research Center (NBKRC) by NBKRC contributor Professor Ronald Mann of the Columbia Law School.

|

|